A Comparison of 5G Core Network Architectures

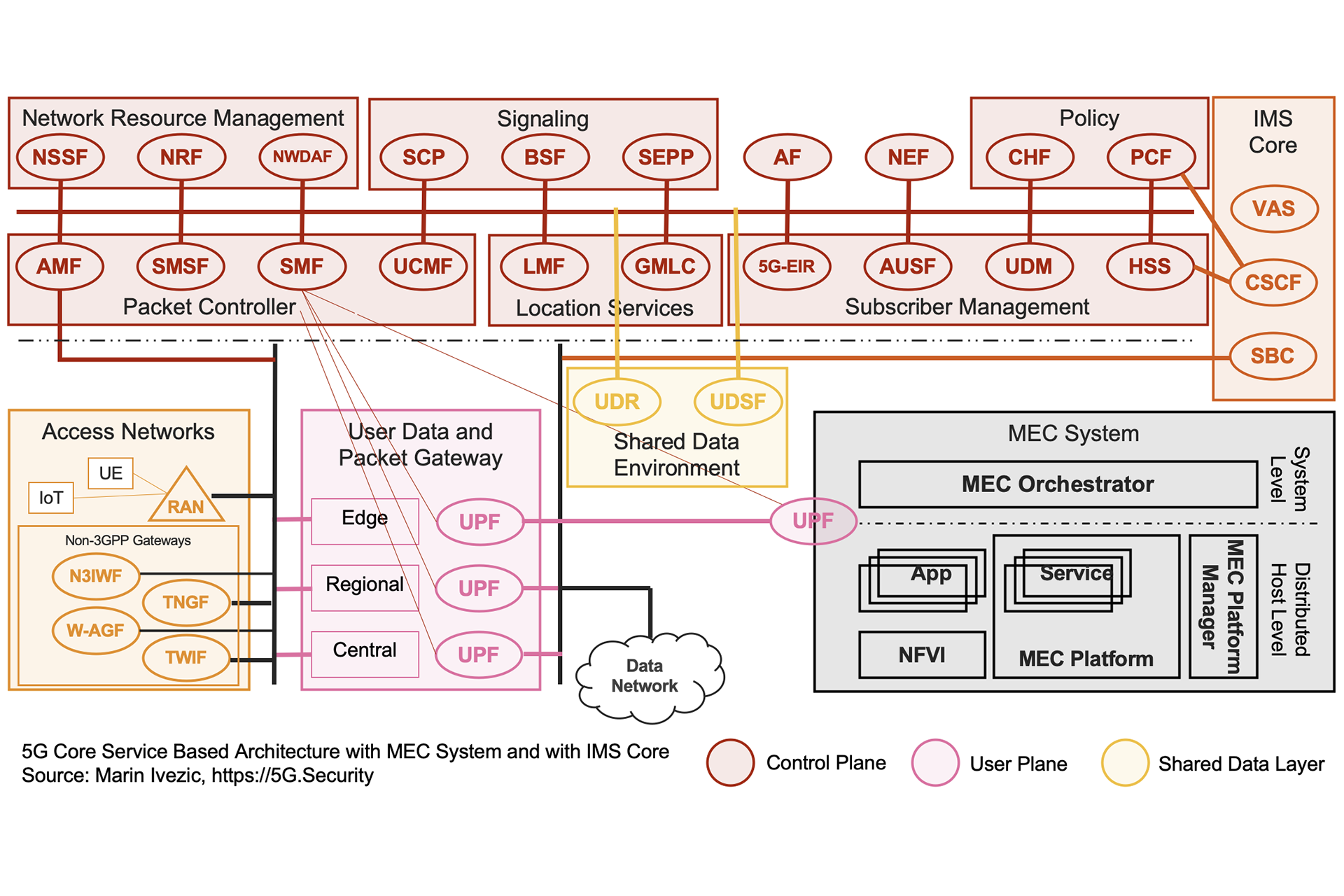

The 5G Core network is a Service Based Architecture. It evolves the traditional appliance based 4G Core Network to support services. It offers more agility and flexibility.

The major building blocks of this architecture include

- Service-Based Interface: The Service Based Interfaces rely on HTTP/2

- The 5G Network Functions: As explained by Ericsson “is built using IT network principles and cloud native technology. In this new architecture each Network Function (NF) offers one or more services to other NFs via Application Programming Interfaces (API). Each Network Function (NF) is formed by a combination of small pieces of software code called as microservices.” The Network Functions are all “Virtual”.

- Cloud Native Functionality: The 5G core is Cloud Native, i.e., it leverages microservices, containers, orchestration, CI/CD Pipelines, APIs, and service meshes etc.

- Control & User Plane Separation (CUPS): This functionality is critical for 5G as it allows operators to separate the control plane that can sit in a centralized location and for the user plane to be placed closer to the application it is supporting.

- Edge Computing: With CUPS (control and user plane separation) the data plane can be moved closer to Edge for lower latency requirements leading to Edge Computing.

- Network Slicing: This functionality leverages virtualized functionality to logically connect different physical resources to support a specific service for different business needs.

This paper reviews the 5G Core Network architecture capabilities and current deployments of the major 5G vendors including:

- Ericsson

- Huawei

- Nokia

- ZTE

- Cisco

According to Dell’Oro, as of 2019, Ericsson and Huawei share the top two spots in MCN (Mobile Core Network) followed by ZTE and Nokia and then Cisco. This includes market share for both the legacy as well as the 5G Core that is triggered by 5G Standalone (SA) launces.

In 2020 Huawei and ZTE increased their dominance over Nokia and Ericsson as China aggressively launched 5G Standalone ahead of other countries. Overall Huawei is the leading Telecom Equipment vendor followed by Nokia and Ericsson.

Overview

The 5G core market is purported to grow at a whopping 72% CAGR to $9.5B by 2025. As per Dell’Oro this market is dominated by Ericsson, Huawei, Nokia with Samsung and ZTE as the challengers. We review the 5G Core Network Architectures as proposed by different players divided into two categories:

- Traditional Equipment Vendors: Nokia, Ericsson, Cisco, Huawei, ZTE

- Disruptive Players: Samsung, Mavenir, Casa systems, Affirmed Networks.

Core Network Architecture Evolution from 4G to 5G

The Core Network Architecture evolution depends on the mobile operator choices. 3GPP has specified different options, shown in the following figure from GSMA. The options are grouped as SA (Standalone) vs NSA (non-Standalone). SA refers when only one radio access technology is used vs NSA refers to the option when both LTE and 5G radio access technologies are used simultaneously:

- Option 1: The tradition enodeB (eNB) connected to an EPC

- Option 2: 5G Standalone (SA): 5G NR nodeB (gNB) connected to the 5GC

- Option 3: A non-Standalone (NSA) eNB is connected to a 4G Core, and gNB is connected to the enodeB – it comes in three variants: Option 3, 3a and 3x with different connectivity options between the gNB and eNB

- Option 4: A non-Standalone (NSA) deployment, where both LTE and 5G NR radio access technologies are deployed and controlled through only 5GC. The eNB is routed to the 5GC via the gNB. Has options 4, 4a

- Option 5: A standalone (SA) deployment; an evolved eNB connected to 5GC

- Option 7: An NSA 5GNR nodeB (gNB) is the master, connected to the 5G Core and eNB as the slave

The question arises on why migrate to a 5G core? The following reasons provide the rationale for the migration:

5G Core is Cloud Native

The 5G Core is being built with a cloud Native Architecture with microservices and that can be reused for supporting other Network Functions. The Cloud Native Architecture will be built on CI/CD pipelines. Such an architecture will speed up development and operational efficiency by deploying a DevOps approach

5G Core enables Network Slicing

Network slicing is enabled by the cloud native architecture. Multiple logical functions can be defined on the same physical architecture. It enables a mobile operator to support new services and business models for a variety of services like Massive IoT, Industrial IoT and Evolved Mobile Broadband. The 5G use cases enabled by a 5GC include augmented reality, factory automation, mission critical communications.

5G Core supports Edge Computing

The scenarios for Edge Computing including local breakout of traffic. As is explained in the reference, “the reduction in latency, increase in service reliability and traffic and services isolation will contribute to an overall enhancement in the end-user experience. The list of capabilities goes on, but here are a few others:

- Service exposure and traffic steering functionalities provide additional tools for service differentiation

- Enhanced QoS model; more flexible than in 4G will allow multiple services (QoS flows) per PDU Session

- Security is improved with enhanced key handling and a unified authentication model

- Service differentiation per geographical e.g., control access to FWA services or other localized services”

5G Core Comparison

As a part of this paper we compare the support of the 5G vendors

In the following section we further discuss aspect of the of 5G Core network.

5G Core Network by Ericsson

Ericsson Dual-Mode Cloud Core Solution support EPC and 5GC functionality on a single platform.

Major Customers who have launched Ericsson 5G Core

The following customers have launched an Ericsson 5G Core as of the writing of this article:

- Rogers Canada

- Singtel Singapore

- China Mobile.

- China Telecom.

- BT network in the UK,

- Telefónica Deutschland

- SmarTone Hong Kong

Ericsson claims the world’s first in 5G Core and NR SA and as per GlobalData, is a leader in 5G Core. “The solution has gained significant market momentum, which currently includes 64+ 5G contracts, 33+ live Non-Standalone (NSA) deployments, and 100+ Standalone (SA) trials in the planning or execution stages.”

5G Core Network by Huawei

Huawei has highlighted the importance of 5G Deterministic Network to provide a differentiated and deterministic experience to customers. “Deterministic Networking” builds on Network Slicing and Mobile Edge Computing.

Huawei’s commercial 5G Core launches include

Huawei talks about 5G deterministic networking (5GDN) that enables5G use cases including 5GDN+smart devices, 5GDN+machine vision, 5GDN+AR man-machine collaboration, and 5GDN+AI+smart transportation/energy.

These use cases are possible because 5G DN SLAs guarantee reliability, service availability, etc. In the Industrial Internet with stricter requirements, IEEE and IETF have defined the TSN standards to study deterministic communication development in industrial automation, vehicle management, and other fields.

5G Core Network by Nokia

Nokia’s Core Network Architectural View also depicts the migration to 5G SA architecture

Nokia 5G Commercial Launches / Deals include

- Starhub Singapore

- T-Mobile USA

- Tele2 in 2021

- Telenor Group

- China Unicom

- Singapore M1

- Telia Sweden, Denmark, Estonia, Finland, Lithuania and Norway

As Nokia explains, “5G is not just a technology upgrade. To unleash its potential requires a rethink of how the network is designed and managed” and “Nokia Universal Adaptive Core is:

- Done right: it is cloud-native and infrastructure-agnostic by design. Deploy it on any cloud – private or public, centralized or distributed, with an optimized performance footprint for any deployment model.

- Done now: it simplifies the complexity with the latest technology to boost the top line and lower costs. Open and programmable, it creates an innovation engine for a strategic business advantage – today.

- Made real: it meets stringent reliability & quality requirements, because it is created and delivered by Nokia with its broad portfolio and global experience, including hundreds of core deployments (Cloud Packet Core, VoLTE, SDM, Policy, Charging, Signaling, etc.)”

5G Core from ZTE

ZTE has been aggressively testing 5G SA with Orange, launched with 5G SA MTN Uganda. ZTE has a 5G E2E Slicing architecture and has been working Industrial Automation Opportunities with 5G technology.

ZTE has rolled out 5G SA core for China Mobile. Three China Mobile Operators will rollout 1M+ gNBs in 2021.

ZTE offers a vision of what a successful 5G Core deployment looks like in this graphic that includes connected house, connected things, connected city, connected people, connected health, connected transportation:

At Mobile World Congress in 2019, ZTE presented the “Enhanced 5G Core, Enabling 2B New Business”.

Cisco 5G Core

Cisco has a presence in the 4G packet core with its acquisition of Starent in 2009. It continues to build on that acquisition for piece of the 5G Core business. Cisco has a very strong IP networking and security portfolio that it adds on to its existing offering to position itself as a key 5G security player. The following figure talks about the 5G Core Cloud Native Core with Network Slicing, and Mobile Edge Computing and the importance of an end-to-end security layer for a 5G Network. The security aspects covered include:

- the connectivity layer,

- DNS protection layer,

- Application security,

- NGFW and DDoS protection,

- segmentation and isolation

- malware protection

Cisco 5G Core Customers

Disruptive Players

As per GlobalData [Link updated Feb 2022] the disruptors in the mobile core space are Affirmed Unity Cloud (acquired by Microsoft), Samsung 5G Core, Casa Systems Axyom 5G Core and Mavenir 5G Core. A quick overview as per GlobalData:

Affirmed Unity Cloud

Affirmed Unity Cloud is being deployed by: Inventec, CHT, AT&T, DNA, Milicom and Netmore, showing early customer momentum. Microsoft’s acquisition can be positive from a funding perspective but could dilute its laser focus on mobile core solutions. Affirmed, as part of Microsoft’s Cloud business unit, may be challenged to maintain a cloud-neutral stance regarding third party clouds.

5G Core by Samsung

Samsung has demonstrated market momentum and operational experience – via penetration in Korean telco operators deploying early 5G standalone (SA) networks. Samsung is well positioned in O-RAN to deliver end-to-end solutions, based on open RAN standards. Samsung’s open-source PaaS plus its Samsung Cloud Orchestrator (SCO) provides an effective automation platform. Samsung’s limitations include limited marketing presence outside of the Korean telco market. It may take some time to transition from trials to significant deployments. Samsung has a whitepaper on the 5G Cloud Native Core on a 5G Migration Strategy.

The white paper also reviews the 4G to 5G migration options.

Samsung whitepaper lays out the evolution path towards 5G NSA + SA + WiFi in the years to come.

Samsung’s Cloud Native 5G Core is planned for Korea Telecom and being trialed in Czech Republic with Deutsch Telecom.

Mavenir 5G Core

Mavenir strengths include that it is integrated with ONAP and ETSI based MANO solutions which appeals to operators for management and orchestration. Mavenir is highly visible in the Open RAN Policy Coalition to bring open and interoperable solutions to the RAN and has established engagements with operators such as Dish Networks and Vodafone IDea, providing it with a basis to deploy its 5GC and ORAN solutions. Mavenir utilizes cloud-native technologies to interwork with legacy protocols. Mavenir’s limitation is that it has not named operators who are using its 5G core in trials or commercial deployments.

From a LightReading article “Mavenir has enjoyed significant mobile core network wins in Europe, India and Japan. Top operators, including Turkcell, Telefónica and Deutsche Telekom, alongside upstarts like Rakuten Mobile in Japan and Dish Network in the US, have purchased the company’s offerings”.

Casa 5G Core

Casa has not publicly announced 5G engagements with service providers, It notes engagement PoCs and trials.

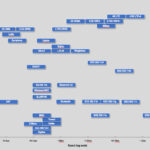

Gartner’s Magic Quadrant for 5G Infrastructure Providers

Gartner recently updated its magic quadrant for 5G Vendors that shows the competitive landscape end-to-end. The capabilities of the 5G infrastructure include:

- Radio access network equipment, radio units (RU), base band units (BBU) for 5G new radio and 4G LTE:

- Passive antennas, RU, AAU, vBBU, BBU, DU, CU, vDU, vCU, small cell

Core network equipment, including 5G next-generation core and evolved packet core (EPC):

- UPF, AMF, SMF, PCF, AUSF, UDM, NSSF, NRF, NEF, NWDAF for 5G

- MME, S-GW, P-GW, IMS, HSS, PCRF, EPC/vEPC for 4G LTE

Conclusion

This paper compares the major 5G Core Network vendors, the features and their customers. The paper describers the leaders including Huawei, Ericsson followed by Nokia, ZTE and Cisco. Then we compare some of the disruptors on the 5G Core Network including Affirmed, Mavenir etc.

In 2021 there will a major move towards 5G SA to realize the special 5G use case that possible with a legacy 4G core which will cause an increase in investment. These vendors are poised to be the winners in this race.

Marin Ivezic

For over 30 years, Marin Ivezic has been protecting critical infrastructure and financial services against cyber, financial crime and regulatory risks posed by complex and emerging technologies.

He held multiple interim CISO and technology leadership roles in Global 2000 companies.