5G Policy and Regulatory Checklist

Ultra high speed, high quality 5G networks are expected to provide the connectivity required for massive IoT adoption, remote robotic surgery as well as instant movie downloads and 3D mobile gaming. The technology boasts incredible reliability and low latency and promises to enable the next industrial revolution and society 5.0. Assuming that 5G policy and regulatory issues are sorted out.

However, recent hype generated by mobile operators and false promises inevitably mean that unreasonable early expectations will go unmet. So far, China and Huawei have out-competed Americans in development and deployment of 5G technology. The Trump Administration is keenly aware of and sensitive to falling behind in this tech sector, not just from a commercial perspective, but also because the Chinese are gaining an edge in related surveillance and military intelligence capabilities.

Geopolitics are just one of the many aspects of public policy and regulatory frameworks that will need to be worked out before global 5G services can reach even half of their full potential. Other factors to be checked off the list include: 1) setting of technical standards, 2) deployment of extensive additional network transmission capacity, 3) allocation and licensing of spectrum for 5G mobile connectivity, 4) getting access to towers and other antenna sites, 5) achieving better security for critical infrastructure and 6) dealing with local and national political concerns. Let’s consider each of these threshold issues separately.

Standards Setting and 5G Policy

To make global interoperability possible, new technical standards must be set for network infrastructure equipment, smartphones and IoT sensors alike.

An article associated with the 2019 World Economic Forum described the global standards setting process for 5G as “engineers from rival inventing companies, rival product makers, rival network operators, all from different countries and continents, discussing, testing, striving to perfect tens of thousands of different technical solutions…” This process follows an open, consensus driven and merit-based approach with no hard deadlines to meet. Ongoing standards deliberations are fraught with geopolitical and commercial rivalry challenges as well as the core technical ones.

One traditional telecom network standard: Common Public Radio Interface or CPRI, defined in 2003, is the best known standard for local point-to-point connections between cell tower transmitters/receivers and mobile networks using fiber optic cables. Currently, telecommunications standards bodies IEEE and 3rd Generation Partnership Project or 3GPP are working out complex technical issues toward coming up with a next generation standard. For the time being however, CPRI will remain the typical interface for 5G network deployment, even though it’s not really up to the job long term.

The IEEE, which developed the standard on which Wi-Fi based, is considering a standard for 5G through its Next Generation Fronthaul Interface group (NGFI 1914.1 Working Group). The mission of this group is to establish the architecture for transport of 5G fronthaul traffic, and recommend new functional partitioning between remote radios and Internet backhaul networks. The ITU, an agency of the UN, also works on consensus global technical standards for telecom networks, but its slower, more political process will leave it playing ‘catch up’ on a next generation standard interface for 5G.

Deployment of Additional Network Transmission Capacity

For major undersea cabling, new transatlantic and transpacific projects laying fiber optic capacity are led by the big Internet platforms like Google and Facebook and greatly supplement existing fiber cables originally deployed by telecom operators in the 1990s and early 2000s.

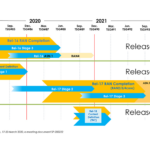

But that still leaves massive infrastructure yet to be deployed within each country. Fiber optic cabling in both the longer range ‘backhaul’ links that connect cell towers and massive regional data centers, and especially more localized ‘fronthaul’ portions of the network will be necessary to support 5G service deployment. One comprehensive report, Optical Networking Opportunities in the 5G Infrastructure Market 2019-2028 by CIR-Inc. estimates that annual sales revenue for optical cabling worldwide will peak in 2021 at around $10B.

Somewhat mitigating the need for more fiber transmission capacity, micro data centers can now be housed in containers in urban areas for storage of popular video content closer to end users, and even at the base of cell towers, which are also closer than the nearest big concrete data center. Microsoft/LinkedIn’s Open 19 Project and others are developing this technology. Adequate security and power supplies at towers are ongoing challenges for micro data centers.

Allocating and Licensing Sufficient Spectrum for 5G

Each national government must allocate and license sufficient spectrum for both fixed wireless links and mobile 5G connections. 5G networks need spectrum within three key frequency ranges to deliver widespread coverage and support all use cases. The three ranges are: Sub-1 GHz, 1-6 GHz and above 6 GHz. A key focus at the ITU World Radiocommunication Conference in 2019 (WRC-19) will be on establishing international agreement on 5G bands above 24 GHz. Regional and global harmonization of spectrum use is required to promote interoperability and prevent interference.

Fixed wireless links, using technologies called CBRS, mm-wave and cm-wave, on frequencies in the prime mid and higher bands like 3.5 GHz, 24GHz and 28 GHz, are ideal alternatives to fiber lines for 5G connectivity in dense urban locations, so they are being deployed early on. Contiguous spectrum blocks are required for each operator. The U.S. FCC has opened up these frequencies for 5G. There will never be enough spectrum to satisfy all the demand of all competing mobile operators, so those operators will also rely on using unlicensed spectrum similar to the frequencies Wi-Fi networks run on. Unlicensed just means there’s no legal protection from electromagnetic interference from other users.

AT&T, Verizon, T-Mobile, Sprint, DISH Network and Frontier are among the 40 companies the FCC has qualified to bid in its auctions 5G spectrum licenses. The FCC held its first 5G spectrum auction in 2018 in the 28 GHz band. In March 2019, the FCC began an auction in the 24 GHz band, and auctions in the upper 37 GHz, 39 GHz, and 47 GHz bands will be held later in the year. The FCC’s March auction drew nearly $1B in bids in its first week, already topping the take from last year’s 28 GHz auction millimeter-wave auction. New York and L.A. are the most popular markets with Chicago in distant third.

Meanwhile, European telcos have been paying even larger sums for 5G spectrum, with so many different countries running auctions for the same frequency blocks.

Ligado Networks is an American satellite communications company developing a satellite-terrestrial network to support 5G and IoT applications in North America. It has 40 MHz of spectrum licenses in the nationwide block of 1500 MHz to 1700 MHz spectrum in the L-Band.

Meanwhile there’s an ongoing policy battle in the U.S. surrounding the so-called C-band satellite spectrum that could be key for next-generation 5G wireless networks. A coalition of satellite providers known as the C-Band Alliance hopes to privately sell off spectrum licenses to wireless providers as a way to speed up 5G deployment. Their opponents want to use an FCC auction instead to get the spectrum to mobile operators. Cable TV companies and others wary of private spectrum transactions, including prominent members of Congress from both parties, have criticized the C-Band Alliance approach and are working on bipartisan legislation to mandate a regulatory spectrum auction.

There’s also the potential for U.S. federal government spectrum to be leased out and shared for commercial 5G use, but that’s an unprecedented initiative from the Commerce Department that faces major bureaucratic hurdles. Most other countries don’t hoard nearly as much spectrum for their national government/military use, and so there’s less urgency about sharing it with commercial 5G operators elsewhere in the world.

Getting Access to Towers and Other Antenna Sites

Traditionally, the process for obtaining access to municipal infrastructure like utility poles and underground conduits has been cumbersome, often politically charged and filled with regulatory delays. Google Fiber discovered this reality the hard way in roughly 2011-2014.

Mobile telecom operators that place cellular transmission devices on privately owned towers, by contrast, have a bit easier time of it when large towers have already passed regulatory muster such as environmental reviews. Tower owners like Phoenix Tower International, operating throughout North, Central and South America, are promoting micro data centers at the base of towers that might ease the spike in demand for greater 5G backhaul capacity.

Compared with traditional cellular networks, 5G technology involves smaller cells and exponentially more of them. Operators must negotiate with local private property owners including outdoor retail malls and office buildings for mounting of their 5G antennas. That means that some cities with high urban density will be able to support 5G more easily than they could ordinary cellular services requiring larger cell towers to cover a wider area.

But the new small cells also mean lots more local politics come into play as municipalities aim to facilitate both deployment of 5G consumer mobile service and ‘smart city’ sensors and cameras for civic Internet of Things (IoT) functions like vehicular and pedestrian traffic control.

Achieving Better Security for Critical Infrastructure Through 5G Policy and Regulation

It’s always been an important priority of most national governments to protect their physical critical infrastructure like roads, bridges, railways, electric and power utilities. But as 5G service is activated, it will not only enable better system monitoring and response time, but also accelerate and compound the nefarious efforts of IT hackers as well.

In light of the reality that 5G networks will carry so much of the world’s business in real time, from medical procedures, to financial transactions, to remote industrial automation to military operations, to delivery of local emergency services, it will become the most critical infrastructure of all time. Accurate risk assessment will become hugely important for all enterprises and not just for insurance purposes, although that industry itself will also be transformed.

Protection of personal data and public policies around data privacy are already a big regulatory issue in Europe with the adoption of the GDPR and its implementation in 2018. Attention to this issue has been growing globally with revelations about Facebook’s carelessness in its handling of personal data. New baseline digital privacy laws are being considered in many jurisdictions, and may well include restrictions on 5G mobile operators’ own collection and use of personal data they transmit.

Furthermore, the emergence of quantum internet connectivity in the next decade poses exponential new cybersecurity challenges. Quantum technology is expected to be capable of breaking 99% of the encryption used by today’s enterprises, including data stored on a digital blockchain. That means that nation states, including their military departments, will need to upgrade to quantum-resistant hardware and cryptography soon, before quantum computers become available sometime in the next decade. SKTelecom, South Korea’s largest mobile operator has already developed Quantum Key Distribution (QKD) technology for its 5G network.

Identifying the right approaches to security of 5G networks, especially in a post quantum world, will require government leadership and extensive and sustained collaboration among commercial and public sector enterprises, including major research universities and nationals labs.

Dealing with Local and National Political Concerns

5G is like Artificial Intelligence (AI) in terms of being an overused and abused buzzword. Telecom operators know that it’s considered a very hot consumer item, and coveted by businesses looking for a competitive edge, so they hold it out as a bargaining chip to get things they want from regulatory agencies, like approval of corporate mergers, spectrum licenses and deregulation. On the other hand, city and state/provincial governments insist on assurances that the digital divide will not be aggravated by 5G ‘redlining’ of less profitable, lower income neighborhoods, which would also contribute to the problem of ‘data poverty’ that can inject bias into artificial intelligence.

On the global stage, amid serious concerns about falling behind China on 5G, the White House just named its first Chief Technology Officer since 2016, and European and Japanese governments and companies have kicked into high gear on 5G as well.

Although US telecom operators battle with municipalities over fees for access to utility infrastructure, sometimes reaching breakthrough new deals for 5G like the one in San Jose, CA many major cities around the world are less demanding as telecom landlords or are simply overridden by their national governments and/or state-owned mobile operators.

Conclusion

Each private and public sector stakeholder in the massive global transition to 5G should create their own checklist of threshold public policy and regulatory concerns that are mission critical for them in particular. Only then can enterprises get ahead of serious challenges and meaningfully collaborate with others toward finding comprehensive solutions.

Marin Ivezic

For over 30 years, Marin Ivezic has been protecting critical infrastructure and financial services against cyber, financial crime and regulatory risks posed by complex and emerging technologies.

He held multiple interim CISO and technology leadership roles in Global 2000 companies.